Kredittkort Test – Why Are Credit Cards Important?

There are several reasons why using a credit card is a wise decision. Credit cards are useful because they can help you build credit, simplify your monthly budget, give you with rewards, and make everyday purchases more convenient. Not only is neither of those things necessary, but there is also no reason to get into debt.

Hard cash used to play a key role. Cash and checks (which are effectively cash) were the most common forms of payment, with credit cards being used for larger, less frequent purchases if at all. They are accepted nearly everywhere now, and some people no longer even carry paper money.

In other words, it is possible to utilize credit cards without going into debt. You can avoid debt and interest charges associated with credit cards if you treat your card like cash and pay off your balance in full every month. Find out more on this page.

Also, many factors go into determining an individual’s APR, but the most significant are their creditworthiness, payment history, and the type of credit card they use. Someone with a long and successful credit history may be eligible for a lower interest rate compared to someone who has shorter or nonexistent credit history.

Credit cards are different from debit cards in several ways. Just what does this signify? A debit card is a payment card that is directly linked to a bank account, such as a checking or savings account.

Table of Content

Credit cards offer a more secure payment method and are easier to carry

The money in your wallet will be gone forever if you lose it or if you are robbed. However, you will not be held liable for any purchases made with your credit card if fraudsters use your card to make illicit purchases. There will be no loss of money, but the resulting confusion may require some time to resolve.

Risks exist even while using a debit card. The credit card firm may suffer significant financial loss if your card is used fraudulently. If your debit card is lost or stolen, the fraudulent purchases will be deducted immediately from your bank account.

Eventually, you should get your money back as long as you report the scam within an acceptable time frame. Things may not be settled for a long time. During that time, you may have trouble paying your bills since your checks may be returned unpaid, your automated payments may be refused due to insufficient funds, and so on.

Credit cards are a convenient way to rack up points quickly

Credit card and debit card users are enticed to use their cards more frequently by a variety of benefits. A simple flat-rate card that gives the same amount on every purchase might earn you 1.5–2% of every dollar you spend.

Payment might be made in hard currency or in the form of a currency like frequent flyer miles or points that can be exchanged for a variety of services. You can make between $180 and $240 each year with no additional effort if you spend $1,000 every month.

It’s true that certain credit cards offer higher perks than others when used at specific types of stores and businesses, such as grocery stores, petrol stations, and restaurants. The benefits you gain from using a single card can be greatly enhanced by combining the benefits from several distinct cards.

However, you should not go out of your way to spend more money than usual in order to rack up extra points. Buying $100 more in food or $250 more in clothes isn’t going to be covered by a modest cash reward.

It’s best to pay off your debt in full whenever feasible because the interest you accrue by carrying a balance from one month to the following can easily outweigh the incentives you get. You can check out the kredittkort test 2023 to discover more about your options!

Spending can be more easily tracked with a credit card

It makes no difference what you do with your money if you chose to spend it. The key idea to take away from this is that it may be difficult to keep a close eye on your financial situation at all times. The challenge of recouping the misplaced funds, however, is a challenging one.

If you do not have a receipt, it is extremely difficult, if not impossible, to demonstrate how much cash you spent and where you spent it. But what about checks? Because you won’t be able to track the status of a check until the recipient deposits and cashes it, you should make a note of it in your check register as soon as possible.

When you make a purchase using a credit card, the information about the transaction will be updated practically immediately on your online account to reflect the newly added charges.

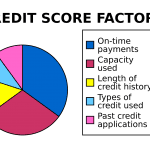

Building a healthy credit history might be aided by using credit cards

To achieve a high credit score, you need not have a credit card or carry a load on one. On the other side, the best way to improve credit ratings is through careful credit card use, and a strong credit score can lead to many new doors opening for you. Finding a place to live is simplified, whether you’re applying for a rental or a mortgage loan, and whether or not your landlord pulls your credit report as part of the process.

You should know that utility companies, insurance agencies, and cell phone carriers may all look at your credit report to determine whether or not to offer service to you, and at what cost. Since many employers now conduct credit checks before making a hiring decision, this can actually improve your prospects.

Using a credit card regularly for little purchases, keeping a low amount, and paying your bill on time can all help your score rise over time.

When not to use one?

Every time a customer uses a credit card, the retailer must pay a small fee to the credit card processing provider. Like any other business expense, these fees are virtually usually factored into the final selling price of the retailer’s products.

In some cases, though, the store may charge you a convenience fee or upfront surcharge simply for using your credit card rather than cash or another form of payment. If this occurs, you should probably look for another payment option unless the benefits you obtain from using your credit or debit card outweigh the surcharge.

When you’d prefer that the retailer not pay a certain fee. Similarly, if you’re trying to show your support for a small local business, it’s best to pay cash instead of using a credit card. They won’t have to pay any fees to process your payment if you pay with cash or perhaps a check, which is sure to make them happy.

From the viewpoint of sellers, even debit cards are superior to credit cards. Merchants benefit from this trend because accepting debit cards typically results in lower transaction fees than accepting credit cards.

When you want to avoid spending more money than necessary but Some people may lack the self-control required to use a credit card responsibly.

The fact that your credit card limit is in the five-figure area makes it more challenging to remember all the reasons why you shouldn’t buy that enticing item. If you are concerned about exceeding your credit limit or making a significant purchase, you may prefer to pay with cash or a debit card instead of a credit card.

Credit card holders can enjoy a variety of perks. Make an effort to find the best credit card for your needs by doing some investigation. No matter what kind of payment you choose, you should always exercise responsible spending.