6 Tips to Save on Long Term Care Insurance Cost

When you turn 65, there’s a 70% chance you’ll require some form of long term care, which is expensive.

How costly?

On average, you’ll spend around $100,379 for a private room in a nursing home. Unfortunately, only 7.2 million Americans have purchased long term care insurance, which pays for long term care supports and services such as nursing home, assisted living and home care, not covered by Medicare.

Many individuals think that long term care insurance is expensive. But contrary to popular belief, premiums can be made affordable. Here are tips that can help you save on the cost of long term care insurance.

Table of Content

1. Buy Early

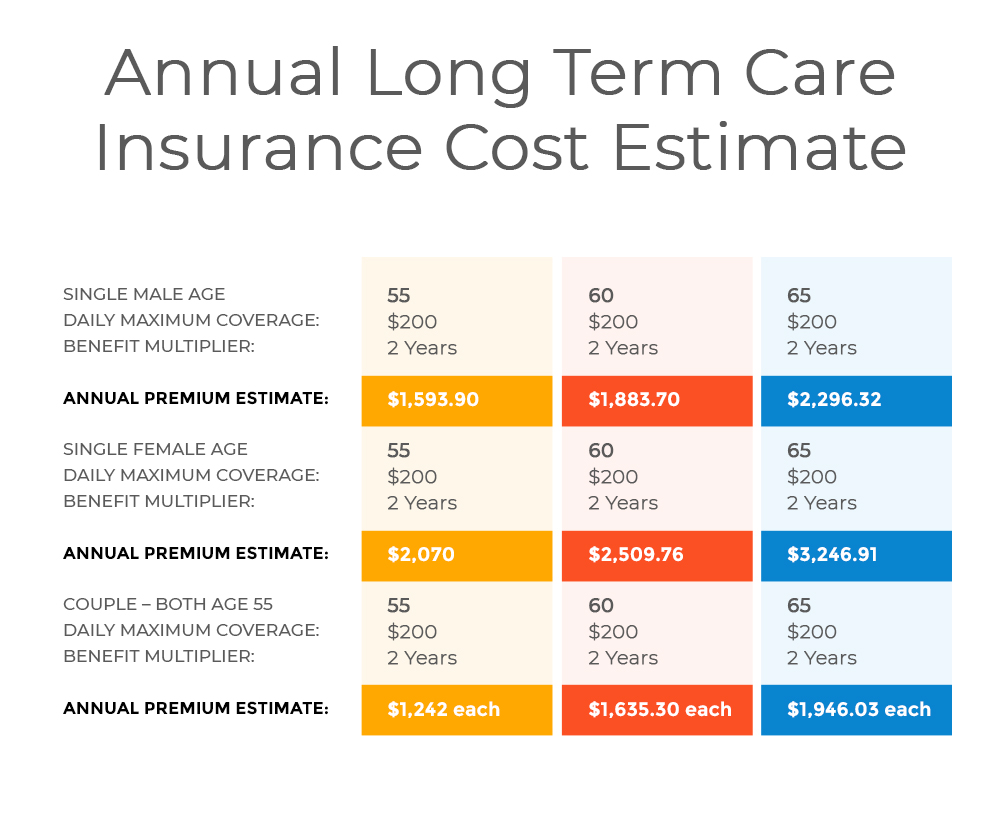

Your premiums are based on different factors including your health and age at the time you purchase long term care policy. Ideally, you want to buy when you’re young and healthy to enjoy health discounts.

Long term care insurance companies give preferred rates to individuals who are young and healthy since they have less chances of needing long term care. In fact, experts agree that the best age to buy long term care insurance is in your 50s, while you’re still young and healthy enough to qualify for affordable rates.

You might end up paying for higher premiums or worse, you will fail to healthy qualify if you opt to delay getting a long term care policy. In fact, 17% of applicants who are 50-59 years old are denied of coverage because of health issues while 45% of applicants 70-79 years old are denied of long term care insurance because of the same reason.

2. Choose the Right Insurer

Long term care insurance companies have different underwriting guidelines. One company might give you favorable rates depending on your health history and policy features you selected but another company might give you higher rates.

These companies also offer policies with different benefits. Choose a company that offers features that will help you maximize your coverage. Look for policy features such as inflation protection, shared care, zero waiting day period, return of premium and waiver of premium.

So, shop around to find the right company that can give you the best rate.

3. Apply with Your Spouse or Partner

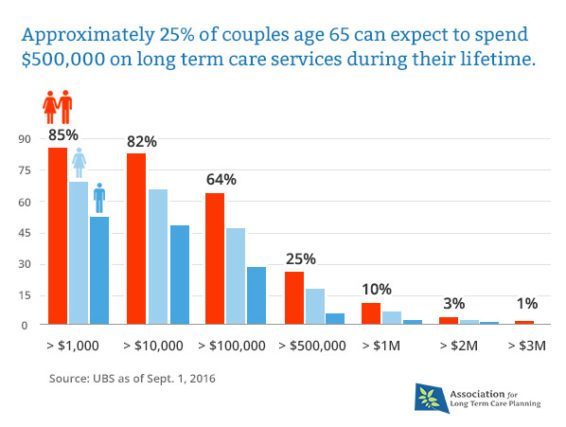

You can save as much as 30% on your premiums if you apply with your spouse or partner. Another benefit of this shared care feature of long term care insurance allows couples regardless if they’re married or not to get coverage enough for two individuals. Meaning, they can combine their long term care benefits into a pool that they can both use.

In case that only one spouse is approved, some carriers give partial discount to the one who is approved.

Couples should consider this since about 25% of couples age 65 can expect to spend $500,000 on long term care during their lifetime.

4. Design your Plan Wisely

You can personalize your coverage based on your needs and income. You can reduce your premiums by making adjustments on your daily benefit, benefit period and elimination period.

If you’re confident that you can cover some long term care costs out-of-the-pocket, you can lower your daily maximum benefit. Similarly, if you can afford to pay for a few months of your care expenses, increase your waiting period to lower your premiums.

Considering inflation protection such as simple inflation, compound inflation, and future purchase is wise even if that means increasing your premiums because it allows your policy to keep up with the rising cost of long term care.

Adding the return of premium rider to your policy is a wise decision for individuals who want to leave a legacy to the people they care about. This type of rider will return all or just a portion of your premiums to your beneficiary when you die.

There are a lot of policy features to choose from so just choose policy features that can satisfy your long term care needs in the future.

5. Consider Group Discounts

Group long term care insurance or an employer-sponsored policy has appealing advantages including simplified underwriting, group discounts, unisex rates, low and stable premiums.

Premiums of a group policy are lower compared to individual policies and will less likely increase unless you add more features to your policy. But a group policy will only favor individuals who can no longer health qualify and subject to high premiums. You’re better of with a standalone long term care insurance if you’re healthy since you’re eligible for a 10% discount.

This type of policy is also perfect for women who want to save on premiums. Women usually pay more than men because they live much longer than men, which mean they will most likely require long term care.

6. Pay Premiums Annually

By paying your premiums annually you can save up to 9% on your premiums. You don’t need to worry when your premium is due because your carrier will send you a premium notice before your anniversary date. If you have more than enough money, consider paying your premiums annually.

Also, this will prevent you from forgetting to pay for your premiums that will result in a policy lapse.

Final Word

Saving on long term care insurance premiums isn’t that hard at all. You just have to plan for the financial risk of paying for long term care and to get long term care insurance early. Explore your options well and choose the best way to help you bring down your premiums without sacrificing your long term care benefits and putting your loved ones at risk in the future.